Understanding Term Life Insurance

Term life insurance is one of the most straightforward and cost-effective types of life insurance available. It provides financial protection for a specified period, or “term,” and is designed to offer a death benefit to your beneficiaries if you pass away during this period. This guide delves deep into term life insurance, exploring its features, benefits, drawbacks, and considerations to help you make an informed decision. Vision Insurance: A Comprehensive Guide 2024

Table of Contents

Sun Life Insurance Claim: A Comprehensive Guide 2024

Sun Life Insurance Claim: A Comprehensive Guide 2024 Navigating the process of filing an insurance c…

Professional Liability Insurance: Best Guide 2024

A Comprehensive Guide to Professional Liability Insurance (Errors & Omissions) Professional liab…

Understanding TATA AIG Insurance: A Comprehensive Guide 2024

Regarding securing the future, nothing stands out quite like insurance. It’s the comforting cushion …

Understanding Ladder Life Insurance 2024: Climbing the Rungs of Financial Security

Ladder Life Insurance: When it comes to securing your financial future and providing for your loved …

Best Guide to Motorcycle Insurance 2024

A Comprehensive Guide to Motorcycle Insurance Motorcycle insurance is essential for protecting rider…

Allstate Car Insurance: Comprehensive Coverage and Benefits 2024

Allstate Car Insurance, one of the largest insurance providers in the United States, offers a range …

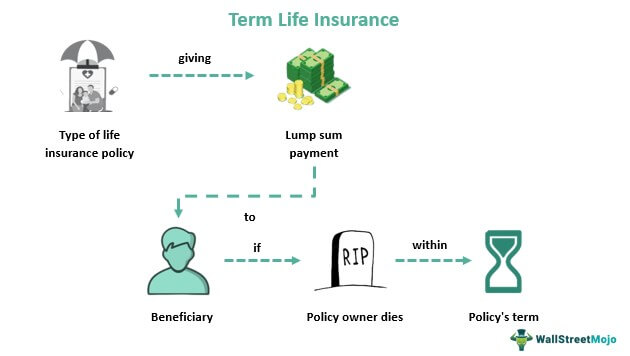

What is Term Life Insurance?

Term life insurance provides coverage for a predetermined period, such as 10, 20, or 30 years. If the policyholder dies within the term, the insurance company pays a death benefit to the beneficiaries. Unlike permanent life insurance policies, term life insurance does not build cash value over time and is purely focused on providing a death benefit.

Key Features of Term Life Insurance

- Fixed Term: The coverage lasts for a specific period, known as the term. Common term lengths are 10, 15, 20, and 30 years.

- Level Premiums: Premiums are generally fixed for the duration of the term. This means the amount you pay each month or year will not change.

- Death Benefit: If the policyholder dies during the term, the beneficiaries receive the death benefit, which is typically a lump sum payment.

- No Cash Value: Term life insurance does not accumulate cash value or savings. Its sole purpose is to provide a death benefit.

Types of Term Life Insurance

There are several types of term life insurance, each designed to meet different needs:

1. Level Term Life Insurance

Level term life insurance is the most common type of term life insurance. It provides a fixed death benefit and fixed premiums for the duration of the term.

- Advantages: Predictable premiums and death benefit.

- Ideal for: Individuals looking for straightforward, affordable coverage for a specific period.

2. Decreasing Term Life Insurance

Decreasing term life insurance features a death benefit that decreases over the term of the policy. Premiums usually remain level, but the death benefit reduces annually.

- Advantages: Often used to cover debts that decrease over time, such as a mortgage.

- Ideal for: Homeowners looking to ensure their mortgage is paid off if they die before the mortgage is paid in full.

3. Renewable Term Life Insurance

Renewable term life insurance allows the policyholder to renew the policy at the end of the term without undergoing a medical exam. The premiums for the renewed term are usually higher due to the increased age of the policyholder.

- Advantages: Flexibility to renew coverage without a medical exam.

- Ideal for: Individuals who may want to extend their coverage term without undergoing another medical examination.

4. Convertible Term Life Insurance

Convertible term life insurance provides the option to convert the term policy into a permanent life insurance policy without a medical exam. This feature is typically available for a certain period during the term.

- Advantages: Flexibility to switch to permanent coverage if needs change.

- Ideal for: Policyholders who anticipate a future need for permanent life insurance.

Benefits of Term Life Insurance

Term life insurance offers numerous benefits, making it a popular choice for many individuals and families:

- Affordability: Term life insurance is generally more affordable than permanent life insurance. The lower premiums make it accessible to a broader range of people.

- Simplicity: Term life insurance is straightforward and easy to understand. It provides pure life insurance coverage without the complexities of cash value accumulation.

- Flexibility: With various term lengths available, policyholders can choose the coverage period that best fits their needs, such as the duration of a mortgage or until children are financially independent.

- High Coverage: Term life insurance allows for substantial coverage amounts at affordable rates, providing significant financial protection for beneficiaries.

- Income Replacement: The death benefit can serve as income replacement for the policyholder’s family, helping them maintain their standard of living.

Drawbacks of Term Life Insurance

Despite its advantages, term life insurance also has some drawbacks:

- No Cash Value: Unlike permanent life insurance, term policies do not accumulate cash value. There are no savings or investment components.

- Temporary Coverage: Coverage is limited to the term of the policy. If the policyholder outlives the term, the policy expires, and no death benefit is paid.

- Renewal Costs: Renewing a term policy after the initial term can be expensive, as premiums increase with the policyholder’s age.

- Limited Flexibility: Once the term is selected, it cannot be changed. If the policyholder’s needs change, they may need to purchase a new policy.

Factors Affecting Term Life Insurance Premiums

Several factors influence the cost of term life insurance premiums:

- Age: Younger individuals typically pay lower premiums, as they are generally healthier and have a longer life expectancy.

- Health: Medical history and current health status play significant roles in determining premiums. Healthier individuals usually pay lower premiums.

- Gender: Women often pay lower premiums than men, as they tend to have longer life expectancies.

- Term Length: Longer terms generally result in higher premiums due to the extended coverage period.

- Coverage Amount: Higher death benefit amounts lead to higher premiums.

- Lifestyle: Risky behaviors, such as smoking or participating in hazardous activities, can increase premiums.

- Occupation: Jobs with higher risks of injury or death can result in higher premiums.

How to Choose the Right Term Life Insurance Policy

Choosing the right term life insurance policy involves careful consideration of several factors:

- Determine Your Coverage Needs: Assess your financial obligations, such as mortgage payments, debts, and dependents’ needs, to determine the appropriate coverage amount.

- Select the Right Term Length: Choose a term that aligns with your financial goals and the duration of your financial obligations.

- Compare Quotes: Obtain quotes from multiple insurers to compare premiums and policy features.

- Review Policy Features: Consider features such as convertibility, renewability, and any additional riders that may be beneficial.

- Assess Insurer Reputation: Choose a reputable insurance company with strong financial stability and good customer service.

The Claims Process

Filing a claim for term life insurance involves several steps:

- Notify the Insurer: Contact the insurance company as soon as possible after the policyholder’s death.

- Complete Claim Forms: Fill out the required claim forms provided by the insurer.

- Provide Documentation: Submit necessary documents, such as the death certificate and proof of identity.

- Insurer Review: The insurance company reviews the claim and may request additional information.

- Approval or Denial: The insurer approves or denies the claim based on the policy terms and documentation provided.

- Receive Benefit: If approved, the death benefit is paid to the beneficiaries, usually as a lump sum.

Common Exclusions and Limitations

Term life insurance policies often include exclusions and limitations:

- Suicide Clause: Policies typically exclude coverage for suicides within the first two years of the policy.

- Misrepresentation: Providing false or misleading information on the application can result in claim denial.

- High-Risk Activities: Deaths resulting from high-risk activities, such as skydiving or scuba diving, may be excluded.

- War and Terrorism: Some policies exclude deaths resulting from acts of war or terrorism.

Case Studies

Case Study 1: Young Family with Mortgage

John and Sarah, a young couple with two children, purchased a 20-year term life insurance policy with a $500,000 death benefit. The policy provided affordable premiums and ensured that if either parent passed away, the surviving spouse would have financial support to pay off the mortgage and cover the children’s education expenses.

Case Study 2: Single Parent with Dependents

Emily, a single mother with two young children, chose a 30-year term life insurance policy with a $1,000,000 death benefit. This coverage provided peace of mind that her children would be financially protected and have the necessary funds for living expenses and future education costs if she passed away.

Industry Insights and Statistics

- Prevalence of Term Life Insurance: According to the Insurance Information Institute, about 41% of life insurance policyholders in the United States have term life insurance.

- Affordability: Term life insurance is often the most affordable option for life insurance coverage, making it a popular choice for young families and individuals with temporary financial obligations.

- Conversion Rates: Many term life insurance policies offer the option to convert to permanent life insurance, providing flexibility for policyholders as their needs change over time.

Conclusion

Term life insurance is a vital financial tool that provides affordable, straightforward coverage for a specified period. It is ideal for individuals and families looking for temporary coverage to protect against financial obligations, such as mortgages, debts, and dependents’ needs. By understanding the key features, benefits, drawbacks, and factors affecting premiums, you can make an informed decision about whether term life insurance is the right choice for you. Whether you are seeking to secure your family’s financial future or cover specific financial obligations, term life insurance offers valuable protection and peace of mind.

Sources

- Insurance Information Institute

- American Council of Life Insurers

- National Association of Insurance Commissioners