A Comprehensive Guide to Landlord Insurance

Landlord insurance is a specialized type of property insurance designed for individuals who rent out their homes, apartments, or other properties. This guide explores the features, benefits, coverage options, and considerations of landlord insurance to help you understand its importance and how to choose the right policy. The Best Insurance Companies in the United States: A Comprehensive Guide 2024

Table of Contents

Sun Life Insurance Claim: A Comprehensive Guide 2024

Sun Life Insurance Claim: A Comprehensive Guide 2024 Navigating the process of filing an insurance c…

Professional Liability Insurance: Best Guide 2024

A Comprehensive Guide to Professional Liability Insurance (Errors & Omissions) Professional liab…

Understanding TATA AIG Insurance: A Comprehensive Guide 2024

Regarding securing the future, nothing stands out quite like insurance. It’s the comforting cushion …

Understanding Ladder Life Insurance 2024: Climbing the Rungs of Financial Security

Ladder Life Insurance: When it comes to securing your financial future and providing for your loved …

Best Guide to Motorcycle Insurance 2024

A Comprehensive Guide to Motorcycle Insurance Motorcycle insurance is essential for protecting rider…

Allstate Car Insurance: Comprehensive Coverage and Benefits 2024

Allstate Car Insurance, one of the largest insurance providers in the United States, offers a range …

What is Landlord Insurance?

Landlord insurance, also known as rental property insurance, provides coverage for property owners who rent out their buildings. It typically covers the physical structure of the property, liability for injuries or damages that occur on the premises, and loss of rental income. Unlike homeowners insurance, landlord insurance is tailored to address the unique risks associated with rental properties.

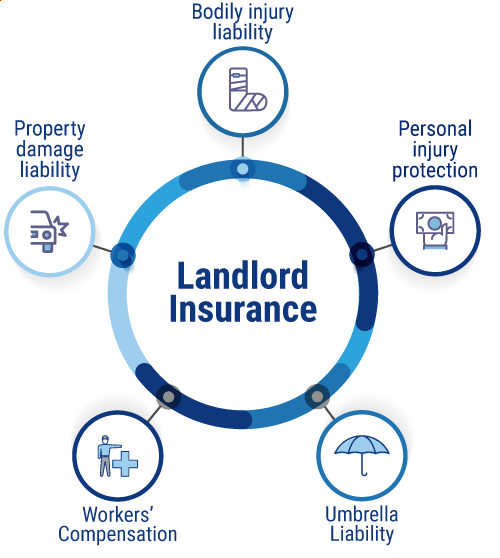

Key Features of Landlord Insurance

- Property Damage Coverage: Protects the physical structure of the rental property against damage from covered perils such as fire, wind, hail, and vandalism.

- Liability Protection: Provides coverage if the landlord is held responsible for injuries or property damage suffered by tenants or visitors.

- Loss of Rental Income: Covers the loss of rental income if the property becomes uninhabitable due to a covered loss.

- Optional Coverages: Additional coverages may include protection for landlord-owned personal property, legal expenses, and equipment breakdown.

Types of Landlord Insurance Policies

There are generally three types of landlord insurance policies, each offering different levels of coverage:

- DP-1 (Basic Form): Covers specific perils listed in the policy, typically including fire, vandalism, and windstorm. This is the most basic form of coverage and usually only provides actual cash value for damaged property.

- DP-2 (Broad Form): Covers more perils than DP-1, including falling objects, weight of ice or snow, and freezing of pipes. It often provides replacement cost coverage for damaged property.

- DP-3 (Special Form): Provides the most comprehensive coverage, protecting against all perils except those specifically excluded in the policy. DP-3 policies typically offer replacement cost coverage and are the most commonly purchased type of landlord insurance.

Benefits of Landlord Insurance

Landlord insurance provides several important benefits for property owners:

- Protection of Investment: Covers the cost to repair or replace the rental property if it is damaged by a covered peril.

- Liability Coverage: Protects against financial loss if the landlord is sued for injuries or damages that occur on the rental property.

- Loss of Rental Income: Provides financial support if rental income is lost due to property damage that makes the unit uninhabitable.

- Peace of Mind: Offers reassurance that the rental property and the landlord’s financial interests are protected.

Common Perils Covered by Landlord Insurance

Landlord insurance policies typically cover a range of perils, including but not limited to:

- Fire and Smoke: Damage caused by fire or smoke.

- Wind and Hail: Damage from windstorms and hail.

- Vandalism: Damage caused by vandalism.

- Water Damage: Damage from water leaks or burst pipes (excluding flooding).

- Theft: Theft of landlord-owned property used to maintain the rental unit.

- Explosion: Damage from explosions.

- Falling Objects: Damage from falling objects such as trees.

Factors Affecting Landlord Insurance Premiums

Several factors influence the cost of landlord insurance premiums:

- Location: Premiums can vary based on the area’s crime rate, susceptibility to natural disasters, and local building costs.

- Property Type: The age, construction materials, and condition of the rental property can impact premiums.

- Coverage Amounts: Higher coverage limits result in higher premiums.

- Deductible Amount: Choosing a higher deductible can lower premiums but increases out-of-pocket costs in the event of a claim.

- Claims History: A history of frequent claims can lead to higher premiums.

- Credit Score: Insurers often use credit scores to determine premiums, with higher scores generally leading to lower rates.

- Policy Discounts: Discounts may be available for safety features like smoke detectors, security systems, and bundled insurance policies.

How to Choose the Right Landlord Insurance Policy

Selecting the right landlord insurance policy involves careful consideration of several factors:

- Assess Your Needs: Determine the level of coverage needed for your property, liability, and rental income.

- Compare Quotes: Obtain quotes from multiple insurers to compare premiums, coverage options, and policy features.

- Understand Policy Exclusions: Review the policy exclusions to understand what is not covered.

- Consider Additional Coverage: Evaluate whether additional coverage options or endorsements are necessary to meet your needs.

- Evaluate Insurer Reputation: Choose a reputable insurance company with strong financial stability and good customer service.

The Claims Process

Filing a landlord insurance claim involves several steps:

- Notify the Insurer: Contact the insurance company as soon as possible after a loss or damage occurs.

- Document the Damage: Take photos or videos of the damage and create an inventory of damaged property.

- Complete Claim Forms: Fill out the required claim forms provided by the insurer.

- Provide Documentation: Submit necessary documents, such as repair estimates and proof of ownership.

- Insurer Review: The insurance company reviews the claim and may request additional information or send an adjuster to assess the damage.

- Approval or Denial: The insurer approves or denies the claim based on the policy terms and documentation provided.

- Receive Payment: If approved, the insurer issues payment for the covered losses.

Common Exclusions and Limitations

Landlord insurance policies often include exclusions and limitations:

- Flood Damage: Standard policies typically do not cover flood damage, requiring separate flood insurance.

- Earthquake Damage: Earthquake damage is generally excluded, requiring separate earthquake insurance.

- Maintenance Issues: Damage from neglect or lack of maintenance is not covered.

- Tenant’s Personal Property: Tenant’s belongings are not covered; tenants should have their own renters insurance.

- Intentional Acts: Damage caused intentionally by the landlord or tenant is not covered.

Case Studies

Case Study 1: Fire Damage to a Rental Property

Mark, a landlord, experienced significant fire damage to one of his rental properties. His landlord insurance policy included property damage coverage, which paid for the repairs to the structure. Additionally, his policy’s loss of rental income coverage compensated him for the rent he lost while the property was being repaired. This allowed Mark to recover financially without a substantial out-of-pocket expense.

Case Study 2: Liability Coverage for a Tenant Injury

Anna, a landlord, faced a lawsuit from a tenant who slipped and fell on icy steps, resulting in a serious injury. The tenant sued Anna for medical expenses and lost wages. Fortunately, Anna’s landlord insurance policy included liability coverage, which covered the legal fees and settlement costs, protecting her from significant financial loss.

Industry Insights and Statistics

- Rising Rental Market: According to the U.S. Census Bureau, rental vacancies have been decreasing, indicating a strong rental market and the increasing importance of landlord insurance.

- Average Cost: The average cost of landlord insurance in the U.S. varies widely depending on the property type and location, but it is generally higher than homeowners insurance due to the increased risks associated with rental properties.

- Common Claims: The most common landlord insurance claims are for water damage, fire damage, and liability, underscoring the importance of comprehensive coverage.

Conclusion

Landlord insurance is a crucial safeguard for property owners who rent out their buildings, providing protection for the physical structure, liability coverage, and loss of rental income. By understanding the key features, benefits, types of policies, and factors affecting premiums, you can make an informed decision about the right landlord insurance policy for your needs. Whether for protecting against fire damage, ensuring liability coverage, or securing rental income, landlord insurance offers valuable peace of mind and financial security.

Sources

- Insurance Information Institute – Landlord Insurance

- National Association of Insurance Commissioners – Landlord Insurance

- U.S. Census Bureau – Rental Housing Market

1 comment

[…] Best Guide to Landlord Insurance 2024 […]