A Comprehensive Guide to Renters Insurance

Renters insurance is an essential yet often overlooked type of insurance that provides financial protection for tenants. This guide explores the features, benefits, coverage options, and considerations of renters insurance to help you understand its importance and how to choose the right policy.

Table of Contents

Sun Life Insurance Claim: A Comprehensive Guide 2024

Sun Life Insurance Claim: A Comprehensive Guide 2024 Navigating the process of filing an insurance c…

Professional Liability Insurance: Best Guide 2024

A Comprehensive Guide to Professional Liability Insurance (Errors & Omissions) Professional liab…

Understanding TATA AIG Insurance: A Comprehensive Guide 2024

Regarding securing the future, nothing stands out quite like insurance. It’s the comforting cushion …

Understanding Ladder Life Insurance 2024: Climbing the Rungs of Financial Security

Ladder Life Insurance: When it comes to securing your financial future and providing for your loved …

Best Guide to Motorcycle Insurance 2024

A Comprehensive Guide to Motorcycle Insurance Motorcycle insurance is essential for protecting rider…

Allstate Car Insurance: Comprehensive Coverage and Benefits 2024

Allstate Car Insurance, one of the largest insurance providers in the United States, offers a range …

What is Renters Insurance?

Renters insurance is a type of insurance policy that provides coverage for a tenant’s personal belongings, liability protection, and additional living expenses in the event of a covered loss. Unlike homeowners insurance, it does not cover the structure of the building itself, which is the landlord’s responsibility.

Key Features of Renters Insurance

- Personal Property Coverage: Protects against the loss or damage of personal belongings due to covered perils such as fire, theft, and vandalism.

- Liability Protection: Provides coverage if the policyholder is responsible for injury to others or damage to their property.

- Additional Living Expenses (ALE): Covers costs of living elsewhere if the rental unit becomes uninhabitable due to a covered loss.

- Medical Payments Coverage: Pays for medical expenses of guests injured on the rental property, regardless of fault.

Types of Renters Insurance Policies

There are typically two types of renters insurance policies based on how the value of the personal property is determined:

- Actual Cash Value (ACV) Policy: Covers the cost to replace items minus depreciation. This type of policy generally has lower premiums but provides less reimbursement for damaged or stolen items.

- Replacement Cost Value (RCV) Policy: Covers the cost to replace items with new ones of similar kind and quality, without deducting for depreciation. This type of policy usually has higher premiums but offers more comprehensive coverage.

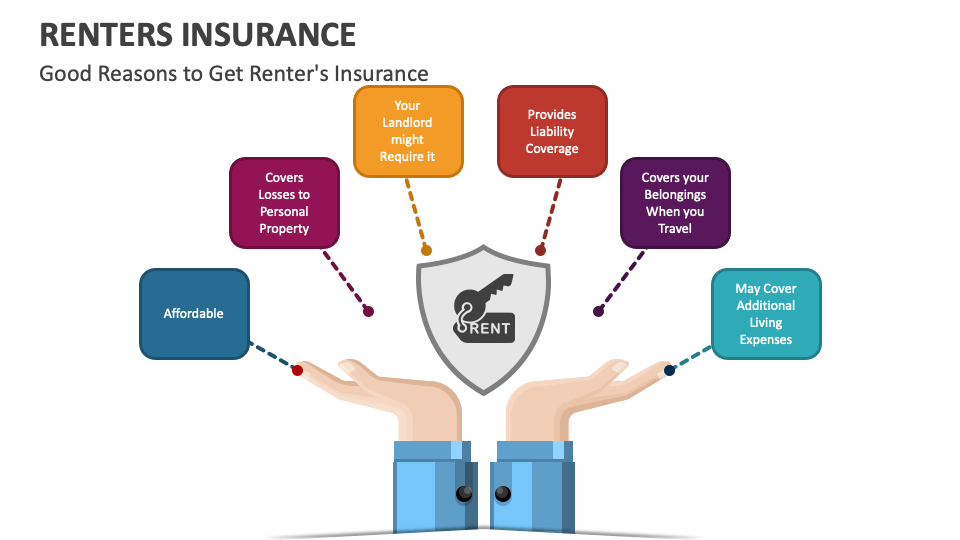

Benefits of Renters Insurance

Renters insurance provides several important benefits for tenants:

- Protection of Personal Belongings: Covers the cost to repair or replace personal items damaged or lost due to covered perils.

- Liability Coverage: Protects against financial loss if the tenant is sued for injuries or damages they are found responsible for.

- Additional Living Expenses: Pays for temporary housing and related expenses if the rental unit is uninhabitable due to a covered loss.

- Affordability: Renters insurance is typically inexpensive compared to the coverage and peace of mind it provides.

- Peace of Mind: Offers reassurance that personal belongings and financial interests are protected.

Common Perils Covered by Renters Insurance

Renters insurance policies typically cover a range of perils, including but not limited to:

- Fire and Smoke: Damage caused by fire or smoke.

- Theft: Loss due to burglary or theft.

- Vandalism: Damage caused by vandalism.

- Water Damage: Damage from water leaks or burst pipes (excluding flooding).

- Weather-Related Damage: Damage from windstorms, hail, or lightning.

- Explosions: Damage from explosions.

- Civil Disturbance: Damage from riots or civil commotion.

Factors Affecting Renters Insurance Premiums

Several factors influence the cost of renters insurance premiums:

- Location: Premiums can vary based on the area’s crime rate and susceptibility to natural disasters.

- Coverage Amount: Higher coverage limits result in higher premiums.

- Deductible Amount: Choosing a higher deductible can lower premiums but increases out-of-pocket costs in the event of a claim.

- Claims History: A history of frequent claims can lead to higher premiums.

- Credit Score: Insurers often use credit scores to determine premiums, with higher scores generally leading to lower rates.

- Policy Discounts: Discounts may be available for safety features like smoke detectors, security systems, and bundled insurance policies.

How to Choose the Right Renters Insurance Policy

Selecting the right renters insurance policy involves careful consideration of several factors:

- Assess Your Needs: Determine the level of coverage needed for your personal property, liability, and additional living expenses.

- Compare Quotes: Obtain quotes from multiple insurers to compare premiums, coverage options, and policy features.

- Understand Policy Exclusions: Review the policy exclusions to understand what is not covered.

- Consider Additional Coverage: Evaluate whether additional coverage options or endorsements are necessary to meet your needs.

- Evaluate Insurer Reputation: Choose a reputable insurance company with strong financial stability and good customer service.

The Claims Process

Filing a renters insurance claim involves several steps:

- Notify the Insurer: Contact the insurance company as soon as possible after a loss or damage occurs.

- Document the Damage: Take photos or videos of the damage and create an inventory of damaged or stolen items.

- Complete Claim Forms: Fill out the required claim forms provided by the insurer.

- Provide Documentation: Submit necessary documents, such as repair estimates and proof of ownership.

- Insurer Review: The insurance company reviews the claim and may request additional information or send an adjuster to assess the damage.

- Approval or Denial: The insurer approves or denies the claim based on the policy terms and documentation provided.

- Receive Payment: If approved, the insurer issues payment for the covered losses.

Common Exclusions and Limitations

Renters insurance policies often include exclusions and limitations:

- Flood Damage: Standard policies typically do not cover flood damage, requiring separate flood insurance.

- Earthquake Damage: Earthquake damage is generally excluded, requiring separate earthquake insurance.

- Pest Infestations: Damage from pests like termites or rodents is not covered.

- Wear and Tear: Damage from normal wear and tear or lack of maintenance is not covered.

- High-Value Items: Standard policies may have coverage limits for high-value items such as jewelry, requiring additional coverage.

Case Studies

Case Study 1: Recovering from a Break-In

Jane, a tenant in an urban apartment, experienced a break-in where her laptop, jewelry, and some cash were stolen. Fortunately, she had a renters insurance policy with personal property coverage. After filing a police report and submitting a claim with her insurer, she received reimbursement for the stolen items based on their replacement cost, allowing her to recover from the loss without significant financial strain.

Case Study 2: Temporary Housing After a Fire

Tom and Lisa rented a house that suffered significant fire damage due to an electrical malfunction. Their renters insurance policy included additional living expenses coverage, which paid for their hotel stay and meals while their rental home was being repaired. This coverage provided crucial support during a difficult time, alleviating the burden of unexpected expenses.

Industry Insights and Statistics

- Prevalence of Renters Insurance: According to the Insurance Information Institute, only about 37% of renters have renters insurance, highlighting the need for greater awareness of its importance.

- Average Cost: The average cost of renters insurance in the U.S. is approximately $15 to $20 per month, making it an affordable option for most tenants.

- Common Claims: The most common renters insurance claims are for theft and water damage, underscoring the importance of coverage for these perils.

Conclusion

Renters insurance is an essential safeguard for tenants, providing protection for personal belongings, liability coverage, and additional living expenses. By understanding the key features, benefits, types of policies, and factors affecting premiums, you can make an informed decision about the right renters insurance policy for your needs. Whether for protecting against theft, ensuring liability coverage, or securing temporary housing, renters insurance offers valuable peace of mind and financial security.

Sources

- Insurance Information Institute – Renters Insurance

- National Association of Insurance Commissioners – Renters Insurance

- American Council of Life Insurers – Renters Insurance