Boating is a cherished pastime for many Americans, offering a unique way to enjoy the great outdoors, whether on serene lakes, winding rivers, or the open sea. However, just like your car or home, your boat represents a significant investment that needs protection. Enter boat insurance—a specialized form of coverage designed to safeguard your vessel and provide peace of mind. In this comprehensive guide, we’ll explore everything you need to know about boat insurance, from the types of coverage available to the factors affecting your premiums. So, let’s set sail on this journey to ensure your boat remains safe and secure.

- The Best Insurance Companies in the United States: A Comprehensive Guide 2024

- Understanding Workers Compensation Insurance: The Essential Guide 2024

- The Fun Guide to Getting Insurance Quotes Online 2024

- Unraveling Term Life Insurance Quotes: A Fun and Informative Guide 2024

- Discovering biBERK Insurance: The Ultimate Guide 2024

Table of Contents

Understanding Boat Insurance: What Is It and Why Do You Need It?

What is Boat Insurance?

Boat insurance is a policy that provides financial protection against physical damage to your boat, as well as liability for injuries or damages that you or someone operating your boat causes to others. Coverage can vary widely depending on the type of boat, its usage, and the insurance provider.

Why Do You Need Boat Insurance?

Owning a boat is not just about the initial purchase price. Maintenance, repairs, docking fees, and unforeseen accidents can quickly add up. Here’s why boat insurance is essential:

- Protection Against Damage: Whether it’s a collision, a storm, or vandalism, boat insurance covers the cost of repairs or replacement.

- Liability Coverage: If you’re at fault in an accident that causes injury or property damage, liability coverage can protect you from significant financial loss.

- Peace of Mind: Knowing you’re covered in case of an accident or other unforeseen events allows you to enjoy your time on the water without constant worry.

For more information on the basics of boat insurance, you can visit the Insurance Information Institute.

Types of Boat Insurance Coverage

1. Physical Damage Coverage

This type of coverage protects your boat from damage caused by various perils, including:

- Collision: Covers damage from collisions with other boats, docks, or submerged objects.

- Weather-Related Damage: Includes damage from storms, lightning, hail, and other natural events.

- Theft and Vandalism: Protects against losses from theft or vandalism.

2. Liability Coverage

Liability coverage is crucial if you’re involved in an accident that causes injury or damage to others. It typically includes:

- Bodily Injury: Covers medical expenses, lost wages, and legal fees if you’re found liable for injuries to others.

- Property Damage: Pays for damages to another person’s property, such as other boats or docks.

3. Medical Payments Coverage

This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

4. Uninsured/Underinsured Boater Coverage

Just like with auto insurance, this coverage protects you if you’re involved in an accident with an uninsured or underinsured boater.

5. Additional Coverages

Depending on your needs, you might also consider:

- Towing and Assistance: Covers the cost of towing your boat if it becomes disabled on the water.

- Personal Effects: Covers personal items on your boat, such as fishing equipment, navigation gear, and clothing.

- Fuel Spill Liability: Provides coverage for the accidental discharge of fuel into the water.

For a detailed overview of different types of boat insurance coverage, check out Geico’s Boat Insurance.

Factors Affecting Boat Insurance Premiums

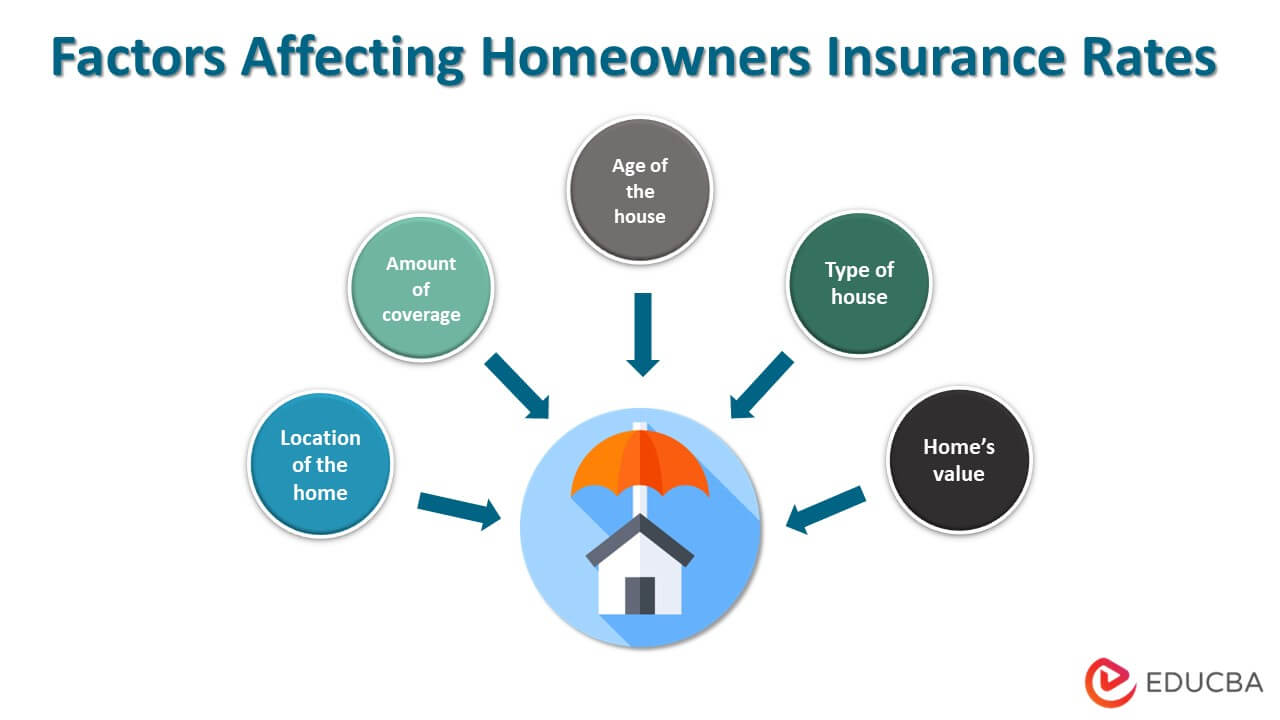

Several factors can influence the cost of your boat insurance premiums:

1. Type and Size of Boat

The larger and more powerful the boat, the higher the premium. Luxury yachts, for example, will cost more to insure than a small fishing boat.

2. Usage

How you use your boat affects your premiums. Boats used for high-risk activities like waterskiing or commercial purposes will have higher premiums.

3. Location

The area where you boat can also impact your insurance rates. Coastal areas prone to hurricanes or regions with high theft rates may have higher premiums.

4. Experience and Claims History

Experienced boaters with clean records will typically pay less for insurance. Previous claims can increase your premiums.

5. Storage and Security

Where you store your boat (in a marina, at home, or in dry storage) and the security measures in place (alarms, tracking devices) can affect your insurance costs.

For more insight into what affects boat insurance premiums, visit Progressive Boat Insurance.

Tips for Saving on Boat Insurance

1. Shop Around

Get quotes from multiple insurance providers to ensure you’re getting the best rate. Companies like Allstate and State Farm offer competitive rates and discounts.

2. Bundle Your Policies

Many insurers offer discounts if you bundle your boat insurance with other policies, such as home or auto insurance.

3. Take a Boating Safety Course

Completing an accredited boating safety course can earn you a discount on your insurance premiums. Check out courses offered by the U.S. Coast Guard or BoatUS Foundation.

4. Increase Your Deductible

Opting for a higher deductible can lower your premium. Just make sure you can afford to pay the deductible in case of a claim.

5. Install Safety and Security Features

Installing safety features such as fire extinguishers, marine radios, and security systems can qualify you for discounts.

For more tips on saving on boat insurance, visit Nationwide Boat Insurance.

How to Choose the Right Boat Insurance Policy

1. Assess Your Needs

Consider the type of boat you have, how you use it, and the risks you’re exposed to. This will help you determine the coverage you need.

2. Compare Policies

Look at the coverage options, limits, and exclusions of different policies. Don’t just go for the cheapest option—make sure it provides adequate protection.

3. Check the Insurer’s Reputation

Research the insurer’s financial stability, customer service, and claims process. Websites like AM Best and J.D. Power provide ratings and reviews of insurance companies.

4. Read the Fine Print

Understand what is and isn’t covered by your policy. Pay attention to exclusions and limitations, and ask questions if anything is unclear.

5. Seek Professional Advice

If you’re unsure about what coverage you need, consider consulting with an insurance agent or broker who specializes in boat insurance.

For more guidance on choosing the right boat insurance, visit BoatU.S..

Common Boat Insurance Myths

Myth 1: Homeowners Insurance Covers My Boat

While homeowners insurance might provide limited coverage for small boats, it typically doesn’t cover larger vessels or liability for boating accidents. Specialized boat insurance is necessary for comprehensive protection.

Myth 2: Boat Insurance is Too Expensive

Boat insurance is often more affordable than people think. Many factors influence the cost, and discounts can help make it more economical.

Myth 3: I Only Need Insurance During Boating Season

Accidents and theft can happen year-round, even when your boat is in storage. Year-round coverage ensures your boat is protected at all times.

Myth 4: Older Boats Don’t Need Insurance

Regardless of your boat’s age, it’s still at risk for damage and liability. Insurance can cover repairs and protect you from financial loss.

For a deeper dive into common boat insurance myths, check out Insurance Information Institute’s Myths.

Conclusion

Boat insurance is an essential safeguard for your valuable investment, offering protection against damage, liability, and more. By understanding the types of coverage available, the factors that affect your premiums, and the steps you can take to save money, you can find the right policy to suit your needs. Whether you’re a seasoned sailor or a weekend warrior, having the right boat insurance ensures that you can enjoy your time on the water with confidence and peace of mind.

For further reading, consider exploring these resources:

Safe sailing, and don’t forget to anchor your boat insurance policy before you set out on your next adventure!