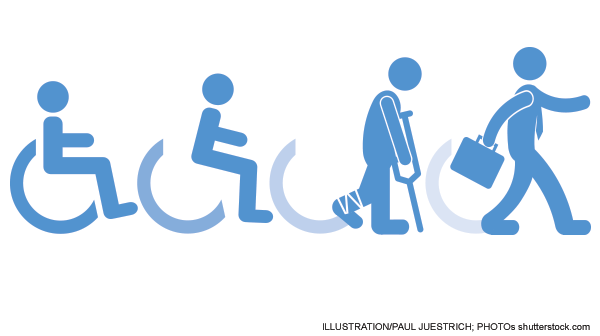

Understanding Disability Insurance

Disability insurance is a type of coverage that provides income protection to individuals who become unable to work due to a disability. This can include both short-term and long-term disabilities arising from illnesses, injuries, or accidents. Disability insurance ensures that individuals can maintain their financial stability even when they cannot earn an income.

Table of Contents

Sun Life Insurance Claim: A Comprehensive Guide 2024

Sun Life Insurance Claim: A Comprehensive Guide 2024 Navigating the process of filing an insurance c…

Professional Liability Insurance: Best Guide 2024

A Comprehensive Guide to Professional Liability Insurance (Errors & Omissions) Professional liab…

Understanding TATA AIG Insurance: A Comprehensive Guide 2024

Regarding securing the future, nothing stands out quite like insurance. It’s the comforting cushion …

Understanding Ladder Life Insurance 2024: Climbing the Rungs of Financial Security

Ladder Life Insurance: When it comes to securing your financial future and providing for your loved …

Best Guide to Motorcycle Insurance 2024

A Comprehensive Guide to Motorcycle Insurance Motorcycle insurance is essential for protecting rider…

Allstate Car Insurance: Comprehensive Coverage and Benefits 2024

Allstate Car Insurance, one of the largest insurance providers in the United States, offers a range …

Importance of Disability Insurance

Disability insurance is essential for several reasons:

- Income Protection: It provides a financial safety net, replacing a portion of lost income if you cannot work due to a disability.

- Financial Stability: Helps maintain your standard of living and meet ongoing financial obligations such as mortgages, loans, and daily living expenses.

- Peace of Mind: Offers peace of mind knowing that you have financial protection in case of unexpected health issues.

- Employer Benefits: Often included in employee benefits packages, it adds value to employment compensation.

Types of Disability Insurance

Disability insurance comes in various forms, each designed to meet different needs and circumstances:

1. Short-Term Disability Insurance (STD)

Short-term disability insurance provides coverage for a limited period, typically from a few weeks to up to one year. It is designed to cover temporary disabilities that prevent an individual from working for a short duration.

- Benefits Period: Usually lasts from 3 to 6 months.

- Waiting Period: Typically has a short waiting period before benefits begin, often 1 to 14 days.

- Coverage: Replaces a percentage of your income, usually between 50% to 70%.

2. Long-Term Disability Insurance (LTD)

Long-term disability insurance provides coverage for extended periods, often until retirement age, depending on the policy. It is designed for more severe disabilities that prevent an individual from working for a longer duration.

- Benefits Period: Can last from several years to the age of retirement.

- Waiting Period: Typically has a longer waiting period before benefits begin, often 90 to 180 days.

- Coverage: Replaces a percentage of your income, usually between 50% to 70%.

3. Social Security Disability Insurance (SSDI)

SSDI is a federal program that provides benefits to individuals who have worked and paid into the Social Security system but are now unable to work due to a disability.

- Eligibility: Requires a significant work history and a qualifying disability as determined by the Social Security Administration.

- Benefits: Based on your average lifetime earnings before becoming disabled.

4. Supplemental Disability Insurance

Supplemental disability insurance is additional coverage that you can purchase to enhance your existing disability insurance, whether it’s employer-provided or individual coverage.

- Benefits: Helps cover gaps in income replacement and provides more comprehensive financial protection.

Coverage and Benefits

Disability insurance coverage and benefits can vary widely depending on the policy. Key elements to consider include:

- Definition of Disability: Policies can define disability in various ways. Some may cover you if you cannot perform your current job, while others may require that you be unable to perform any job suited to your education and experience.

- Benefit Amount: Typically, disability insurance replaces a percentage of your pre-disability income, often between 50% and 70%.

- Benefit Period: The duration for which benefits are paid. Short-term policies may cover a few months, while long-term policies can cover several years or until retirement.

- Elimination Period: The waiting period before benefits begin, ranging from a few days to several months.

- Non-Cancelable Policies: Ensure that the insurer cannot cancel the policy as long as premiums are paid.

- Renewability: Some policies guarantee renewability, meaning you can renew the policy without a medical exam.

Factors Affecting Disability Insurance Premiums

Several factors influence the cost of disability insurance premiums:

- Age: Younger individuals typically pay lower premiums as they are less likely to become disabled.

- Health: Pre-existing conditions and overall health can affect premium costs.

- Occupation: Jobs with higher risks of injury or illness may result in higher premiums.

- Benefit Amount: Higher benefit amounts and longer benefit periods usually come with higher premiums.

- Policy Features: Additional features like cost-of-living adjustments and residual disability benefits can increase premiums.

Employer-Provided vs. Individual Disability Insurance

Disability insurance can be obtained through an employer or purchased individually:

Employer-Provided Disability Insurance

- Advantages: Often more affordable due to group rates; premiums may be partially or fully paid by the employer.

- Disadvantages: Coverage may be limited; benefits are typically taxable if the employer pays the premiums.

Individual Disability Insurance

- Advantages: Offers more customizable coverage options; benefits are usually tax-free if you pay the premiums with after-tax dollars.

- Disadvantages: Generally more expensive than employer-provided plans.

The Claims Process

Filing a disability insurance claim involves several steps:

- Notify the Insurer: Inform your insurer as soon as possible about your disability.

- Complete Forms: Fill out the necessary claim forms, including detailed information about your disability and medical condition.

- Provide Documentation: Submit medical records, doctors’ statements, and proof of income.

- Insurer Review: The insurer reviews your claim, which may involve additional medical evaluations or vocational assessments.

- Approval or Denial: The insurer approves or denies the claim based on the policy terms and provided documentation.

- Appeal: If denied, you can appeal the decision and provide additional information or documentation.

Common Exclusions and Limitations

Disability insurance policies often include exclusions and limitations:

- Pre-Existing Conditions: Disabilities resulting from pre-existing conditions may not be covered for a certain period.

- Self-Inflicted Injuries: Disabilities resulting from self-inflicted injuries are typically excluded.

- Substance Abuse: Disabilities resulting from substance abuse may not be covered.

- Mental Health Conditions: Some policies have limitations on coverage for disabilities due to mental health conditions.

Tips for Choosing Disability Insurance

To choose the right disability insurance policy, consider the following tips:

- Assess Your Needs: Determine how much income replacement you need to maintain your lifestyle and meet financial obligations.

- Understand the Definitions: Ensure you understand the policy’s definition of disability and the conditions under which benefits are paid.

- Compare Policies: Compare multiple policies from different insurers to find the best coverage and premiums.

- Review Exclusions: Be aware of any exclusions or limitations in the policy.

- Consider Supplemental Coverage: Evaluate if you need additional coverage to fill gaps in employer-provided plans.

The Role of Disability Insurance in Financial Planning

Disability insurance is a crucial component of a comprehensive financial plan. It protects against the financial impact of losing your ability to earn an income due to a disability. By securing disability insurance, you can ensure financial stability and protect your long-term financial goals.

Case Studies

Case Study 1: Short-Term Disability Insurance

John, a 35-year-old marketing manager, sustained a severe injury while playing sports, resulting in a three-month recovery period. John had a short-term disability insurance policy through his employer, which replaced 60% of his income during his recovery. This coverage allowed John to focus on his recovery without worrying about his financial obligations.

Case Study 2: Long-Term Disability Insurance

Sarah, a 42-year-old software engineer, was diagnosed with a chronic illness that prevented her from working for an extended period. Sarah had purchased an individual long-term disability insurance policy that replaced 70% of her income. This policy provided Sarah with financial stability and allowed her to manage her medical expenses and daily living costs.

Industry Insights and Statistics

- Prevalence of Disability: According to the Social Security Administration, more than one in four 20-year-olds will become disabled before reaching retirement age .

- Financial Impact: The Council for Disability Awareness reports that the average long-term disability claim lasts 34.6 months .

- Income Replacement: Disability insurance typically replaces 50% to 70% of an individual’s pre-disability income .

Conclusion

Disability insurance is a vital safety net that protects individuals from the financial consequences of losing their ability to work due to a disability. By understanding the different types of disability insurance, coverage options, and factors affecting premiums, individuals can make informed decisions to ensure they have the necessary protection. Whether through employer-provided plans or individual policies, disability insurance plays a crucial role in maintaining financial stability and peace of mind.

1 comment

[…] Disability Insurance: A Comprehensive Guide 2024 […]